The National Flood Insurance Program (NFIP)

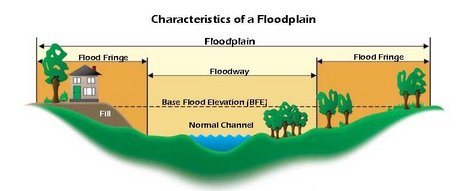

Periodically, rivers, streams and lakes will overflow their banks and inundate adjacent land areas. These areas, known as floodplains, temporarily store this excess water. Flood damages occur only when man interferes with the natural flooding process by altering the watercourse, developing areas in the upper watershed, and/or building

inappropriately in the floodplain itself.

The traditional solution to flood problems has been to build structural protection works such as dams, diversions, levees and floodwalls. Despite tremendous expenditures for these structural projects, economic flood losses have continued to increase year after year. Given this, governments at every level have begun to see the solution to avoiding flood damages lies not in keeping the water away from people, but rather in keeping people away from the water. This philosophical shift lead to the creation of the National Flood Insurance Program (NFIP) in 1968, thereby codifying the concept of floodplain

management.

The base flood, sometimes referred to as the 100-year flood, has a 1% chance of occurring in any given year. Although a 100-year flood sounds remote, keep in mind that over the life of an average 30-year mortgage, a home located within the 100-year flood zone (A or V zone) has a 26% chance of being inundated by the base flood. This same home has less than a 1% chance of fire damage during the same period.

The Flood Smart website is a good source of information for those having flood insurance. Read through and understand flood insurance.

Find out if your property is in a floodplain. Visit the FEMA website to determine your status.

Advocate@fema.dhs.gov . Contact the FEMA Flood Insurance Advocate for problems with flood insurance or flood maps.

FEMA FORMS. Get the latest version of the Elevation Certificate, LOMA, LOMR, etc. by visiting FEMA's website.

County Floodplain Development Permit Application. For those properties that are within the flood hazard area, a County Floodplain Development Permit is required.

NFIP. Learn all about the technical features of flood proofing and other building issues when developing in the special flood hazard areas. These bulletins give the details to be compliant with local, State and Federal standards. Below is a listing of the bulletins, to get a copy of them click on the link above which will take you to FEMA's website where the PDF files are available for download.

Technical Bulletin 1: Openings in Foundation Walls

Technical Bulletin 2: Flood Damage Resistant Materials

Technical Bulletin 3-93: Non-Residential Flood proofing

FLOODPROOFING CERTIFICATE form

Technical Bulletin 4-93: Elevator Installation

Technical Bulletin 5: Free-of-Obstruction Requirements

Technical Bulletin 6-93: Below Grade Parking Requirements

Technical Bulletin 7-93: Wet Flood proofing Requirements

Technical Bulletin 10-01: Ensuring that Structures Built on Fill In or Near Special Flood Hazard Areas are Reasonably Safe From Flooding

Technical Bulletin 11-01: Crawl space Construction for Buildings Located in Special Flood Hazard Areas

Umatilla County FIRM Panels

Umatilla County FIRM Panels. To find out which Flood Panel a property is within, this map will show the new panels (effective September 3, 2010). Once the panel number is known then that panel can be viewed by going to the directory below for the official FEMA FIRM Panel.

CURRENT UMATILLA COUNTY FIRM PANELS (Effective September 3, 2010) Now the whole County is being shown on the same Index map with no individual maps for the cities or the Tribe. The folder that contains the 2010 Panels contains all of the new panels that are now effective as of September 3, 2010. These new panels have the 2006 NAIP imagery as the base layer which shows structures and other features.

Each city manages their own flood hazard zones. Details of those areas can be found here: Adams, Athena, Echo, Helix, Hermiston, MiltonFreewater, Pendleton, PilotRock, Stanfield, Ukiah, Umatilla, Weston

Flood Insurance Study, Volume 1 & 2

A Flood Insurance Study (FIS) is a book that contains information regarding flooding in a community and is developed in conjunction with the Flood Insurance Rate Map (FIRM). The FIS, also known as a flood elevation study, frequently contains a narrative of the flood history of a community and discusses the engineering methods used to develop the FIRMs. The study also contains flood profiles for studied flooding sources and can be used to determine Base Flood Elevations for some areas.

NEW FLOOD INSURANCE STUDY (Effective September 3, 2010). The Flood Insurance Study that has been completed for the new FIRMs is now available for review. This FIS will be effective September 3, 2010 but is here for reference. The new FIS brings all of the County and Incorporated Cities and the CTUIR (Tribe).

Letter of Map Change (LOMC) Issued

There have been a number of Letter of Map Changes (LOMC) issued over the past several years. These documents will modify the FIRM Panels and will affect flood insurance for the parcels involved. Therefore, the documents are important to keep track of and on file in case there is any question as to the status of flooding on the affected parcel(s).

- Learn more about LOMA and LOMR Applications. FEMA's website provides information about the process for a Letter of Map Amendment and Letter of Map Revision.

- How to get a LOMA in a Zone A. This handout was prepared to detail the process for surveyors to apply for a LOMA for properties without a base flood elevation.

Revalidated Letters of Map Changes (LOMCs) List , dated August 18, 2010, recognizes the “Valid LOMCs for Umatilla County” prior to the September 3, 2010 Flood Insurance Rate Maps (FIRMS). Authorized LOMCs do not show up on the official FIRMS so this listing is very important to prove that the change has been recognized and flood insurance is not required.

Below are the LOMA/LOMR cases filed for Umatilla County.

UNINCORPRATED AREAS:

- 2020-10-0248A-410204.pdf

- 2000-10-485A-410204.pdf

- 2002-10-623A-410204.pdf

- 2004-10-0229A-410204.pdf

- 2004-10-0561A-410204.pdf

- 2006-10-0055A-410204.pdf

- 2011-10-0480A-410204.pdf

- 2011-10-0481A-410204.pdf

- 2012-10-1210P-410204.pdf

- 2012-10-1246A-410204.pdf

- 2013-10-0403A-410204.pdf

- 2015-10-0669P-410204.pdf

INCORPORATED CITIES:

ADAMS

ATHENA

MILTON-FREEWATER

- MILTONFREEWATER_12-10-0218A-410210

- MILTONFREEWATER_12-10-1210P-410210

- MILTONFREEWATER_11-10-1181A-410210

PENDLETON

STANFIELD

Helpful Links

National Flood Insurance Program (NFIP) Floodplain Management Requirements (FEMA 450) This is the desk reference and is a very large binder of materials.

Guide to Flood Maps (FEMA 258) This reference item provides more details on reading and understanding flood maps.

FEMA's Technical Bulletins: https://www.fema.gov/emergency-managers/risk-management/building-science/national-flood-insurance-technical-bulletins#

Oregon Building Codes online (read only): http://www.cbs.state.or.us/bcd/programs/onlinecodes.html

FEMA Flood Insurance Manual: https://www.fema.gov/flood-insurance/work-with-nfip/manuals

Appeals, Revisions and Amendments to the NFIP: A Guide for Community Officials (December 2009)

Contact Information

Click here for the Staff Directory

Community Development

216 SE 4th Street, Room 104

Pendleton, OR 97801

541-278-6252

planning@umatillacounty.gov

Other Agency Links

Oregon Building Codes

DEQ

FEMA Flood Insurance Rate Maps

OSU Extension